|

| Finding a method that works for me, has taken years! |

In the early days of my blogging, I was a fanatic user of the FlyLady method of organisation. I read her book, as well as the "Sidetracked Home Executives" by Pam and Peggy Young. I loved their methodology, that tasks should be scheduled, completed and repeated. I decluttered my home.... twice! We had a huge improvement, but we still ended up with with clutter and mess. I then tried using "The Organised Housewife"and followed her method for a while. But what I found was that I was constantly swamped with emails, advertising and other miscellaneous stuff, that simply filled up my inbox and overwhelmed this Struggling Mum with Aspergers.

I have files and folders full of methods, Card files gathering dust and no desire to reopen any of them. My desire to be organised and tidy, has sent me on a quest to make life as simple for my overwhelmed brain, as I can. I have to admit, that I have tried zone cleaning apps, timers, post it notes and reminders on my phone. I ended up with everything everywhere.

|

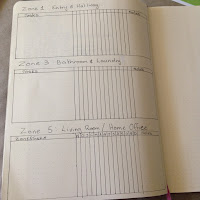

| one of my previous methods |

Since starting my Bullet Journal I had an epiphany. I realised that my desire to simplify was in my hands! I took the fly lady method and the zone cleaning app, and turned it into a visual record in my journal. I have made it easy for myself, because I could never remember what tasks, I completed last month. I therefore had windows that haven't been cleaned in 4 years, because I didn't have something visual and easy to read to keep me accountable. NOW I DO!!!

|

| Setting up my zones |

|

| recording completed tasks is easy |

My simple 2 page spread has all 5 zones, plus a weekend zone for yard work and maintenance. I have drawn it up once. It is now set up for the rest of this year and all of next year. I have also added a notes section, for any details that I need to remember. The beauty of this method, is there are no adverts, I can quickly see what I need to and it is all kept in one spot. I am also working on creating a daily and weekly home blessings chart in my journal for each month, so that I can see what I need to get done in those areas of household work too.

Because I keep my journal with me at all times, I have easy access to all the information that used to clutter my benches, and email. I can now pick up the one journal and know that everything I need for my day is in easy reach for me. It also makes it easy for my hubby, if he wants to know where he can help out (yes my hubby helps me out with housework and cooking :) ).

I love the zone cleaning method. I really wanted it to work for me. So now, I can make it work, because I have control over it, not it having control over me.

For those of you who are interested, this is how it works:

Each month has 5 zones. From the 1st of the month to the end of the 1st week is zone 1. the next full week is zone 2, then zone 3 and 4 follow respectively. Zone 5 happens in the next week, until the end of the month. It is about doing what you can each month.

The Zones are:

1. Entry and Hallway/Stairs

2. Kitchen and Dining Room

3. Bathroom and Laundry

4. Main Bedroom and other Bedrooms

5. Living Room and Home Office.

As FlyLady and the SHE system have already created this method, I give them full credit. I have merely adapted it to suit me. For a more detailed look at this zone method, please check out www.flylady.com.

Coming up next week...

Daily and Weekly home blessing and how to set it up.